Michael Jackson’s Estate Challenges IRS in Tax Dispute

- soulmum

- Utente certificato

- Messaggi: 9304

- Iscritto il: 31 maggio 2016, 12:43

Michael Jackson’s Estate Challenges IRS in Tax Dispute

The Battle Between the Estate of Michael Jackson and the IRS Continues

6/15/2016

by

Larry Brant

| Garvey Schubert Barer

In March 2014, I reported on the all-out battle that was ensuing in the U.S. Tax Court between the IRS and the Estate of Michael Jackson over the value of the late pop singer’s estate. It began in 2013, when the estate petitioned the court, alleging that the Service’s assessment, based upon the assertion that the estate underreported its estate tax obligation by more than $500 million, was incorrect. In addition, the estate challenged the IRS’s additional assessment of almost $200 million in penalties. Keep in mind that although these numbers are staggering, they do not include the estate’s potential state of California estate tax obligations.

If Michael Jackson could instruct his estate lawyers about case strategy, I am sure he would be recounting the lyrics from his 1982 smash hit Beat It:

Just beat it, beat it, beat it, beat it

No one wants to be defeated

Showin’ how funky and strong is your fight

It doesn’t matter who’s wrong or right

Just beat it, beat it

Unfortunately, the case is not going the way Michael Jackson would have wanted it to go. Rather, victory appears to be nowhere in sight for either the taxpayer or the government.

It is now well over two years after the battle started. It continues to rage. Neither the IRS nor the estate is taking the tack from the title of the late pop singer’s 1991 hit song, Give In to Me.

In July 2014, the IRS added a little more pain to the estate’s already existing misery. It took a deeper look at the value of the estate’s ownership rights to the Jackson Five master recordings and the accrued royalties. As a result, the IRS increased the assessment by almost $29 million. Ouch! I am confident Michael Jackson would have responded to the IRS, quoting from his smash hit Leave Me Alone that appeared on the 1987 album Bad:

Leave me alone, stop it!

The IRS either isn’t hip enough to remember the late pop singer’s hit, Leave Me Alone, or it simply isn’t listening! Last week, it asked the court to add another $53 million in value to the estate.

The battle continues roaring strong. The IRS, in its quest to collect more taxes and penalties, appears to be leaving no stone unturned. I apologize in advance to my readers, but I have to quote Michael Jackson one more time; this time from his hit song Scream that appears on the 1995 album HIStory: Past, Present and Future, Book I:

Tired of injustice

Tired of the schemes

The lies are disgusting

So what does it mean

Kicking me down

I got to get up

As jacked as it sounds

The whole system sucks

Trial in this case is currently scheduled for February 2017. It continues to be interesting. Stay tuned! I will follow up if the case resolves or takes another interesting turn.

http://www.jdsupra.com/legalnews/the...tate-of-77132/

6/15/2016

by

Larry Brant

| Garvey Schubert Barer

In March 2014, I reported on the all-out battle that was ensuing in the U.S. Tax Court between the IRS and the Estate of Michael Jackson over the value of the late pop singer’s estate. It began in 2013, when the estate petitioned the court, alleging that the Service’s assessment, based upon the assertion that the estate underreported its estate tax obligation by more than $500 million, was incorrect. In addition, the estate challenged the IRS’s additional assessment of almost $200 million in penalties. Keep in mind that although these numbers are staggering, they do not include the estate’s potential state of California estate tax obligations.

If Michael Jackson could instruct his estate lawyers about case strategy, I am sure he would be recounting the lyrics from his 1982 smash hit Beat It:

Just beat it, beat it, beat it, beat it

No one wants to be defeated

Showin’ how funky and strong is your fight

It doesn’t matter who’s wrong or right

Just beat it, beat it

Unfortunately, the case is not going the way Michael Jackson would have wanted it to go. Rather, victory appears to be nowhere in sight for either the taxpayer or the government.

It is now well over two years after the battle started. It continues to rage. Neither the IRS nor the estate is taking the tack from the title of the late pop singer’s 1991 hit song, Give In to Me.

In July 2014, the IRS added a little more pain to the estate’s already existing misery. It took a deeper look at the value of the estate’s ownership rights to the Jackson Five master recordings and the accrued royalties. As a result, the IRS increased the assessment by almost $29 million. Ouch! I am confident Michael Jackson would have responded to the IRS, quoting from his smash hit Leave Me Alone that appeared on the 1987 album Bad:

Leave me alone, stop it!

The IRS either isn’t hip enough to remember the late pop singer’s hit, Leave Me Alone, or it simply isn’t listening! Last week, it asked the court to add another $53 million in value to the estate.

The battle continues roaring strong. The IRS, in its quest to collect more taxes and penalties, appears to be leaving no stone unturned. I apologize in advance to my readers, but I have to quote Michael Jackson one more time; this time from his hit song Scream that appears on the 1995 album HIStory: Past, Present and Future, Book I:

Tired of injustice

Tired of the schemes

The lies are disgusting

So what does it mean

Kicking me down

I got to get up

As jacked as it sounds

The whole system sucks

Trial in this case is currently scheduled for February 2017. It continues to be interesting. Stay tuned! I will follow up if the case resolves or takes another interesting turn.

http://www.jdsupra.com/legalnews/the...tate-of-77132/

- soulmum

- Utente certificato

- Messaggi: 9304

- Iscritto il: 31 maggio 2016, 12:43

Re: Michael Jackson’s Estate Challenges IRS in Tax Dispute

Looks like Michael is not the only artist that is in Tax Court with the IRS-I've read several articles already about how much the IRS and the State of Minnesota is expecting to get from Prince's estate.

Now it's Whitney:http://www.hollywoodreporter.com/thr...nges-11-897991

MAY 27, 2016 1:48pm PT by Eriq Gardner

Whitney Houston Estate Challenges $11 Million Tax Bill

The The IRS allegedly erred by increasing the value of the singer's publicity rights from $11.5 million to $11.7 million.

The heirs of late pop star Whitney Houston are now in Tax Court over what the Internal Revenue Service claims is owed in estate taxes.

In a May 23 petition, now sealed and first reported byBloomberg, the Whitney Houston estate objected to the determination that $22.6 million has been underreported, which the IRS claims means that more than $11 million is owed, including $3 million in penalties.

Some of the money is attributable to song and performance royalties, including a $9 million dispute over the worth of catalog albums, but it's another discrepancy that is particularly eye-opening.

The Whitney Houston estate said the IRS is in error by increasing the value of the singer's publicity rights from $11.5 million to $11.7 million. How the IRS came to its valuation is unclear, but this provides further evidence that the federal tax agency intends to pursue money from the name and image of dead stars.

With a trial scheduled for next February, the IRS is currently in court with the Michael Jackson estate over the value of the King of Pop's publicity rights. There, the IRS once asserted the value of these rights upon death was $434 million — it's recently backed off from this precise amount — while the Michael Jackson estate argued for just $2,105. Here's more background on the stakes and arguments.

eriq.gardner@thr.comeriqgardner

Now it's Whitney:http://www.hollywoodreporter.com/thr...nges-11-897991

MAY 27, 2016 1:48pm PT by Eriq Gardner

Whitney Houston Estate Challenges $11 Million Tax Bill

The The IRS allegedly erred by increasing the value of the singer's publicity rights from $11.5 million to $11.7 million.

The heirs of late pop star Whitney Houston are now in Tax Court over what the Internal Revenue Service claims is owed in estate taxes.

In a May 23 petition, now sealed and first reported byBloomberg, the Whitney Houston estate objected to the determination that $22.6 million has been underreported, which the IRS claims means that more than $11 million is owed, including $3 million in penalties.

Some of the money is attributable to song and performance royalties, including a $9 million dispute over the worth of catalog albums, but it's another discrepancy that is particularly eye-opening.

The Whitney Houston estate said the IRS is in error by increasing the value of the singer's publicity rights from $11.5 million to $11.7 million. How the IRS came to its valuation is unclear, but this provides further evidence that the federal tax agency intends to pursue money from the name and image of dead stars.

With a trial scheduled for next February, the IRS is currently in court with the Michael Jackson estate over the value of the King of Pop's publicity rights. There, the IRS once asserted the value of these rights upon death was $434 million — it's recently backed off from this precise amount — while the Michael Jackson estate argued for just $2,105. Here's more background on the stakes and arguments.

eriq.gardner@thr.comeriqgardner

- soulmum

- Utente certificato

- Messaggi: 9304

- Iscritto il: 31 maggio 2016, 12:43

Re: Michael Jackson’s Estate Challenges IRS in Tax Dispute

Michael Jackson Estate Fights IRS Over Manager's Deposition

Law360, Washington (November 28, 2016, 4:50 PM EST) -- Michael Jackson's estate and the IRS have pushed back and forth over the agency’s attempt to depose the late singer's business manager, with the estate telling the U.S. Tax Court that the deposition would go beyond the bounds of the suit over alleged millions in additional value in the King of Pop's estate.

The agency and the estate have fought for months over documents and a deposition of Michael Kane, the accountant and former employee of Crowe Horwath LLP who was Michael Jackson’s business manager before the singer’s 2009 death and as an adviser of the estate afterward. Jackson’s estate objected to the latest request by the IRS to depose Kane, and the agency moved on Nov. 22 to compel the deposition.

The estate and the agency are still disputing the valuation of Jackson’s image and other aspects of the estate, and proceeding through discovery in advance of a trial in February in Los Angeles. The estate argued that the agency wants to depose Kane simply to ask questions without the benefit of cross-examination.

“It appears the only reason for the deposition is to have the opportunity to question Mr. Kane prior to trial, which is not a proper use of the deposition,” the objection said.

According to court records, the estate argues that the IRS could have sought the same documents — related to valuations of Jackson’s license and other work — without going through the extraordinary step of deposing a nonparty witness.

“Respondent has failed to establish that the testimony and documents sought from Mr. Kane cannot be obtained through informal consultation or communication,” the objection said.

Furthermore, the estate has argued that the agency can’t assert Kane’s relevance to the case by merely reciting his business relationship to Jackson and his estate.

“Respondent then asserts that ‘Mr. Kane’s testimony is relevant to the valuation and factual issues that remain in dispute in the case,’ without providing any reasons therefor,” the objection said.

The IRS responded that throughout discovery, the estate has engaged in a “pattern of delay” in both informal and formal discovery. The agency’s motion to compel the deposition said the estate has responded sporadically to informal discovery requests, and produced documents “albeit slowly” after being shown a motion to compel in formal discovery.

Depositions are not limited to discover evidence that might otherwise not be presentable at trial, the agency said, asserting that its explanation of the reasons for seeking the deposition were sufficient. In addition, the estate claimed that only a deposition would provide the answers needed for the coming trial.

“Interrogatories regarding Mr. Kane would not have been useful because they do not allow the ability to ask crucial follow up questions (not to mention the petitioner’s likely meaningless responses),” the motion said.

According to the original notice, the IRS adjusted the value of the estate from $7 million to $1.32 billion. As a result, the agency demanded $702 million, including $505.1 million in deficiencies and $196.9 in accuracy-related penalties.

Some of the most notable discrepancies between the valuations of the parties as highlighted in the notice included the right to Jackson’s image and likeness. The IRS pegged that asset at $434.3 million, whereas the estate had claimed the right was worth only $2,105. Additionally, the IRS took umbrage at the estate’s claim it had no “tangible personal property, including vehicle” not reported elsewhere, adjusting that line item from zero to $47.5 million.

In July 2014, roughly a year after the petition was filed, the IRS swung back at the estate, increasing the asserted deficiencies and penalties in the original notice by $29 million to account for a new valuation of the right over the Jackson 5 master recordings and Jackson’s accrued royalties.

A February trial is set for the remaining issues in the case in Los Angeles. The period to make informal discovery requests closed in June.

Counsel for the estate could not be reached for comment. The IRS does not comment on pending cases.

-----------------------

and a june story mentioning what is settled and what is not

IRS Adds $54M To Michael Jackson Estate's Value

Law360, Washington (June 13, 2016, 3:27 PM EDT) -- The IRS piled another $53.6 million onto the valuation of the Michael Jackson estate’s interest in a trust fund Friday, the latest salvo in a protracted U.S. Tax Court battle over how much the world-famous pop star was worth at the time of his 2009 death.

At issue in Friday's IRS adjustment is the value of the estate’s interest in an asset called “New Horizon Trust III.” In its original notice of deficiency, the IRS had said that the interest was worth $60.7 million, balking at what the renowned musician’s estate originally claimed was only a $2.2 million stake. With the latest, $53.6 million adjustment, the agency has logged the asset’s total value at $112 million.

“Respondent has now determined that the notice of deficiency incorrectly reflected the fair market value of this asset,” the IRS wrote to the Tax Court to justify the adjustment Friday. Pursuant to a previous agreement, the IRS would not increase the size of the accuracy-related penalties levied against the estate, the agency explained.

Jackson’s estate had petitioned the Tax Court in July 2013, challenging a lengthy notice of deficiency the IRS mailed to the estate that month. The notice contested the estate’s reported valuation of a litany of items, including a 2001 Bentley Arnage and rights to the master recordings of the Jackson 5.

According to the notice, the IRS adjusted the value of the estate from $7 million to $1.32 billion. As a result, the agency demanded $702 million, including $505.1 million in deficiencies and $196.9 in accuracy-related penalties.

Some of the most notable discrepancies between the valuations of the parties as highlighted in the notice included the right to Jackson’s image and likeness. The IRS pegged that asset at $434.3 million, whereas the estate had claimed the right was worth only $2,105. Additionally, the IRS took umbrage with the estate’s claim it had no “tangible personal property, including vehicle” not reported elsewhere, adjusting that line item from zero to $47.5 million.

In July 2014, roughly a year after the petition was filed, the IRS swung back at the estate, increasing the asserted deficiencies and penalties in the original notice by $29 million to account for a new valuation of the right over the Jackson 5 master recordings and Jackson’s accrued royalties.

That October, however, the parties began to settle on valuations for several issues, including the value of California property interests, Jackson’s “cancellation policy” issued by Lloyds of London, and eventually, the Jackson 5 recordings.

A February 2017 trial is set for the remaining issues in the case, in Los Angeles. The period to make informal discovery requests closed Monday, while the parties are expected next month to exchange information about which experts will be testifying at trial, court records show.

Counsel for the estate could not be reached for comment. The IRS does not comment on pending cases.

Law360, Washington (November 28, 2016, 4:50 PM EST) -- Michael Jackson's estate and the IRS have pushed back and forth over the agency’s attempt to depose the late singer's business manager, with the estate telling the U.S. Tax Court that the deposition would go beyond the bounds of the suit over alleged millions in additional value in the King of Pop's estate.

The agency and the estate have fought for months over documents and a deposition of Michael Kane, the accountant and former employee of Crowe Horwath LLP who was Michael Jackson’s business manager before the singer’s 2009 death and as an adviser of the estate afterward. Jackson’s estate objected to the latest request by the IRS to depose Kane, and the agency moved on Nov. 22 to compel the deposition.

The estate and the agency are still disputing the valuation of Jackson’s image and other aspects of the estate, and proceeding through discovery in advance of a trial in February in Los Angeles. The estate argued that the agency wants to depose Kane simply to ask questions without the benefit of cross-examination.

“It appears the only reason for the deposition is to have the opportunity to question Mr. Kane prior to trial, which is not a proper use of the deposition,” the objection said.

According to court records, the estate argues that the IRS could have sought the same documents — related to valuations of Jackson’s license and other work — without going through the extraordinary step of deposing a nonparty witness.

“Respondent has failed to establish that the testimony and documents sought from Mr. Kane cannot be obtained through informal consultation or communication,” the objection said.

Furthermore, the estate has argued that the agency can’t assert Kane’s relevance to the case by merely reciting his business relationship to Jackson and his estate.

“Respondent then asserts that ‘Mr. Kane’s testimony is relevant to the valuation and factual issues that remain in dispute in the case,’ without providing any reasons therefor,” the objection said.

The IRS responded that throughout discovery, the estate has engaged in a “pattern of delay” in both informal and formal discovery. The agency’s motion to compel the deposition said the estate has responded sporadically to informal discovery requests, and produced documents “albeit slowly” after being shown a motion to compel in formal discovery.

Depositions are not limited to discover evidence that might otherwise not be presentable at trial, the agency said, asserting that its explanation of the reasons for seeking the deposition were sufficient. In addition, the estate claimed that only a deposition would provide the answers needed for the coming trial.

“Interrogatories regarding Mr. Kane would not have been useful because they do not allow the ability to ask crucial follow up questions (not to mention the petitioner’s likely meaningless responses),” the motion said.

According to the original notice, the IRS adjusted the value of the estate from $7 million to $1.32 billion. As a result, the agency demanded $702 million, including $505.1 million in deficiencies and $196.9 in accuracy-related penalties.

Some of the most notable discrepancies between the valuations of the parties as highlighted in the notice included the right to Jackson’s image and likeness. The IRS pegged that asset at $434.3 million, whereas the estate had claimed the right was worth only $2,105. Additionally, the IRS took umbrage at the estate’s claim it had no “tangible personal property, including vehicle” not reported elsewhere, adjusting that line item from zero to $47.5 million.

In July 2014, roughly a year after the petition was filed, the IRS swung back at the estate, increasing the asserted deficiencies and penalties in the original notice by $29 million to account for a new valuation of the right over the Jackson 5 master recordings and Jackson’s accrued royalties.

A February trial is set for the remaining issues in the case in Los Angeles. The period to make informal discovery requests closed in June.

Counsel for the estate could not be reached for comment. The IRS does not comment on pending cases.

-----------------------

and a june story mentioning what is settled and what is not

IRS Adds $54M To Michael Jackson Estate's Value

Law360, Washington (June 13, 2016, 3:27 PM EDT) -- The IRS piled another $53.6 million onto the valuation of the Michael Jackson estate’s interest in a trust fund Friday, the latest salvo in a protracted U.S. Tax Court battle over how much the world-famous pop star was worth at the time of his 2009 death.

At issue in Friday's IRS adjustment is the value of the estate’s interest in an asset called “New Horizon Trust III.” In its original notice of deficiency, the IRS had said that the interest was worth $60.7 million, balking at what the renowned musician’s estate originally claimed was only a $2.2 million stake. With the latest, $53.6 million adjustment, the agency has logged the asset’s total value at $112 million.

“Respondent has now determined that the notice of deficiency incorrectly reflected the fair market value of this asset,” the IRS wrote to the Tax Court to justify the adjustment Friday. Pursuant to a previous agreement, the IRS would not increase the size of the accuracy-related penalties levied against the estate, the agency explained.

Jackson’s estate had petitioned the Tax Court in July 2013, challenging a lengthy notice of deficiency the IRS mailed to the estate that month. The notice contested the estate’s reported valuation of a litany of items, including a 2001 Bentley Arnage and rights to the master recordings of the Jackson 5.

According to the notice, the IRS adjusted the value of the estate from $7 million to $1.32 billion. As a result, the agency demanded $702 million, including $505.1 million in deficiencies and $196.9 in accuracy-related penalties.

Some of the most notable discrepancies between the valuations of the parties as highlighted in the notice included the right to Jackson’s image and likeness. The IRS pegged that asset at $434.3 million, whereas the estate had claimed the right was worth only $2,105. Additionally, the IRS took umbrage with the estate’s claim it had no “tangible personal property, including vehicle” not reported elsewhere, adjusting that line item from zero to $47.5 million.

In July 2014, roughly a year after the petition was filed, the IRS swung back at the estate, increasing the asserted deficiencies and penalties in the original notice by $29 million to account for a new valuation of the right over the Jackson 5 master recordings and Jackson’s accrued royalties.

That October, however, the parties began to settle on valuations for several issues, including the value of California property interests, Jackson’s “cancellation policy” issued by Lloyds of London, and eventually, the Jackson 5 recordings.

A February 2017 trial is set for the remaining issues in the case, in Los Angeles. The period to make informal discovery requests closed Monday, while the parties are expected next month to exchange information about which experts will be testifying at trial, court records show.

Counsel for the estate could not be reached for comment. The IRS does not comment on pending cases.

- soulmum

- Utente certificato

- Messaggi: 9304

- Iscritto il: 31 maggio 2016, 12:43

Re: Michael Jackson’s Estate Challenges IRS in Tax Dispute

Thanks to Ivy from mjjcommunity for the following.

A lot of new information at the latest court ruling about discovery

The parties have filed several motions that the Court needs to decide. Two -- a motion for extension of time for petitioner to respond to requests for admissions, and a motion to seal two documents that are exhibits to petitioner's answer to yet another motion -- are unopposed. The parties also filed a stipulationto slightly change some pretrial deadlines. The Court will grant all of these.

The contested motions are:

Deposition of John Branca

Branca is one ofthe two co-executors of Jackson's will and is actively involved in the estate's businesses and financial planning. Our Court allows depositions of parties, but still treats them as "an extraordinary method of discovery." Rule 74(c)(1)(B). What this division ofthe Court looks for is the general state of discovery, the stakes involved, and whether the depositions would materially aid the trial and possible settlement ofthe cases. The key fact here is that the stakes in this case exceed $1 billion. The Court acknowledges the parties' disagreements about how cooperative each has been in informal discovery, but in a case of this size there is bound to be toing-and-froing between two highly qualified teams of lawyers. It is reasonable to lock down the testimony of a central witness on the key underlying facts, which should shorten the trial and better focus it on what are likely to be quite complicated valuation issues. Respondent's motion is reasonable, and the marginal cost small in relation to the stakes. We will grant respondent's motion.

Deposition of John McClain

McClain is the other co-executor of Jackson's will. His involvement in the day-to-day management ofthe estate's affairs is very unclear from the motion papers. In the motion seeking Branca's deposition, McClain is described as a manager of Triumph Intemational, Inc. which holds and exploits the trademarks related to Jackson on behalf ofthe estate. He is also described as very seriously ill and subject to very poor reactions to stress -- descriptions buttressed by specifics from his doctors that the Court will seal out ofrespect for his privacy -- that would seem inconsistent with the ability to manage a complex enterprise in an industry not widely known for the placidity with which its commercial activity is carried out. Petitioner opposes this motion for essentially the same reasons it does that of Branca, but with the additional and understandable desire to protect McClain's health. McClain's testimony would overlap Branca's in part; but McClain's long friendship with Jackson and his almost equally long involvement in Jackson's music business means that this overlap is not perfect. We will deny this motion. But should respondent issue a trial subpoena for his testimony, and should petitioner or McClain object to it, the Court would expect to hold a brief hearing to determine if McClain's health has interfered with his ability to tend to the estate's day-to-day business.

Deposition of Karen Langford

Langford is an experienced paralegal who participated in the valuation of Jackson's image for the estate's return. She also is knowledgeable about some of the other assets ofthe estate -- for example, unreleased music -- that McClain was also knowledgeable about. His ill health makes her a more important witness. The stakes involved strongly suggest that the costs of formal discovery are reasonable. The Court is also convinced, after reviewing the paperwork, that the deposition of

this witness would materially aid trial of this case. We will grant this motion.

Deposition of Michael Kane

Kane is an accountant and Jackson's former business manager, and has worked on appraisals for the estate and the estate's tax return -- and has even been consulted by petitioners' experts for their work. Respondent also identifies him as a key witness on the penalty issues in the case. Petitioner objects on the grounds that other forms of discovery could be used. Much as with Langford, however, the stakes involved strongly suggest that the costs of formal discovery through themore flexible mechanism of depositions are reasonable. The Court is also convinced, after reviewing the paperwork, that the deposition ofthis witness would

also materially aid trial ofthis case.

Petitioner's Motion to Compel

The estate moved to compel answers to interrogatories, requests for document production, and compliance with a previous discovery order. 1. Interrogatories. Interrogatory 1 is a contention interrogatory aimed at finding out respondent's reason for determining a much higher value for Jackson's likeness. Respondent's answer -- relying on his expert -- is adequate.

Interrogatory 2 seeks the identification of witnesses with knowledge ofthat issue to which respondent replied that he had either named any such witnesses in theexpert report or would include them on his witness list. This is not adequate -- the identification of witnesses is a core object of discovery.

Interrogatories 4 and 5 (about the value ofthe estate's interest in Sony/ATV) and 7 and 8 (about the value ofthe estate's interest in Mijac) follow the same pattern: Look to my experts' reports, says respondent; but ifthe names you seek aren't there, wait for the witness list. Our ruling will likewise be the same.

Interrogatories 11 and 12 ask respondent to identify any people he has interviewed about any of the remaining issues in the case and any who submitted written statements to him. Respondent objects on work-product grounds but, as petitioner correctly notes, petitioner isn't seeking any information about respondent or his representatives but only third parties. With this minor clarification, we agree with petitioner that the information these interrogatories seek is discoverable.

Interrogatory 13 asks for information about the penalties that respondent determined apply to the valuation issues in the case that are still in dispute. On this one, respondent incorporated his answers to previous interrogatories. Our ruling here is consistent with those -- that respondent's answers to 13(a) and (b) are adequate, but he must answer 13(c).

2. Document Production. Petitioner asks us to compel production of two of its requests, numbers 7 and 8. These resemble some of the contested interrogatories in that they seek production of written statements and documents "provided to respondent by any person concerning any issue in this case." Respondent objects on the ground that they are vague, burdensome, and ambiguous. Maybe, if one squinted hard enough. But in context, petitioner is not seeking anything about issues that have already settled -- it's concerned with the three remaining valuation issues and associated penalties. We also don't construe this request to seek work product but only statements and documents from nonparties. With that possibly unnecessary qualification, we will grant this part of petitioner's motion.

3. Compliance with previous order. Petitioner also seeks any documents produced in response to the subpoena duces tecum served on Joseph Zimring. It is possible that respondent's answer to one ofthe interrogatories says there were such documents. If so, respondent must comply with our earlier order.

Respondent's motion to compel production of documents

Respondent seeks, in his own motion to compel, document production that he thinks was inadequate. All his requests seek discoverable information, but petitioner had other objections.

Request number 9 of respondent's second set of document requests seeks any cease-and-desist letters the estate sent to those it thought might be exploiting Jackson's likeness without authorization.

Request number 11 of this set seeks the minutes of Sony/ATV in connection with the estate's sale of its interest in this entity to Sony.

Request number 12 ofthis set asks for appraisals ofthat interest in connection with this sale. These requests are limited and seek discoverable information.

We will grant this part of the motion without further elaboration.

There is another whole category of requests at issue (numbers 13, 19, and 20 in respondent's first set of document requests; and 1-6 of his second set). These are potentially quite burdensome requests for correspondence or agreements between the estate and various businesses interested in using the estate's property,mostly Jackson's image or music. Petitioner did produce some documents in this category ofrequests but also made numerous objections, none ofwhich justify holding back any documents. Where it made a claim of privilege, the estate needed to produce a privilege log so as to enable in camera review or a "quick peek" order under FRE 502; where it took upon itself the burden ofredaction of information it thought "nonresponsive", it violated our Rule 72 because that is not producing them as they are kept in the ordinary course of business; and where it didn't produce them because they contained confidential business information, because they should be produced under seal.

Respondent makes an interesting argument about petitioner's responses to requests number 13 and 19: petitioner's failure to provide a word-tally list or search-term hit frequency. Using such tools can reduce what might otherwise be quite a burdensome exercise; moreover, such terms are themselves a way to cabin discovery. We do not think their use in this large a case would be overly burdensome and will order its use in compliance with this order.

Respondent's motion in limine to exclude the Volokh report

Professor Eugene Volokh of UCLA Law School is widely acknowledged as one ofthe country's leading scholars of First Amendment law, Second Amendment law, and torts. He is even a member ofthe American Heritage Dictionary's Usage Panel. For this case he has prepared an expert-witness report in which he offers his opinion ofthe scope of"legal rights that a prospective buyer would consider when deciding the value of Michael Jackson's name, voice, and likeness (as defined in Cal. Civ. Code § 3344.1)." He's been retained because any deals in this area "will be made in the shadow ofthe law, by parties who are legally sophisticated and well-

counseled." This must be true: A hypothetical rational buyer would not pay the same for narrower rights than he would for broader ones, or the same for uncertain rights than he would for established ones. So it also has to be true that the value of this most contested asset of the estate -- Jackson's posthumous right ofpublicity depends on its legal limits. Professor Volokh opines not on the value of this asset, but on those limits. This means that his report falls within a fairly well-hardened rule that expert testimony about domestic law is generally not admissible. Estate ofCarpenter v. Commissioner, 65 T.C.M. (CCH) 2119, 2120 (1993). This rule is usually accompanied by the line that "testimony about the law does not assist the court." Judges may pretend this is so, but in their hearts they know that many of the lawyers who appear before them know much more about the law than they do. So the rule would be a weak one ifit was helpfulness in reaching the correct result that we focused on. But the rule would be a strong one ifwe focused on the difference between findings of fact and conclusions of law. Courts mostly serve as human lie detectors in evaluating testimony -- they ask ifthe witness broke down on cross, engaged in self-contradiction, or told an incoherent story. Judges are not supposed to conduct private investigations outside the record into the facts of a case. But in reaching a legal conclusion, a judge is less constrained. He is able to consult his own resources and expertise, and looks to the advocates who appear before him for help in where to look. We expect lawyers to zealously advocate for their clients; we're suspicious of witnesses who do so. This is true even when issue before the Court is a mix of law and fact, as it is in the valuation questions in this case. Professor Volokh's proffered testimony would be helpful in drawing the bounds ofthe estate's rights in Jackson's image. But the rule excluding testimony about the content of domestic law is a strong one in this Court. His legal expertise can help the estate to prepare for examination before trial and in argument after the trial, but we find it inadmissible as testimony during the trial. We will grant respondent's motion.

To sum up, it is

ORDERED that petitioner's November 21, 2016 motion to extend the time it has to answer respondent's request for admissions is granted, and petitioner shall serve its answer as supplemented on or before December 5, 2016.

It is also ORDERED that petitioner's December 2, 2016 motion to seal documents is granted, and exhibits A and B to petitioner's opposition to motion to take deposition of John McClain shall be sealed.

It is also ORDERED that the Court will adopt the parties' November 21, 2016 stipulation of pretrial deadlines, and amends the pretrial order in this case asfollows:

a. The last day for filing discovery motions other than to depose expert witnesses shall be extended to November 30, 2016 nunc pro tunc;

b. The last day for filing motions under Rule 90 to contest the sufficiency of answers to requests for admission shall be extended to December 23, 2016;

c. The last day for filing any motions to depose expert witnesses shall be December 23, 2016;

d. Ifthe parties stipulate to taking expert-witness depositions, any notices of those depositions shall be served at least 15 days prior to the scheduled date of thedeposition; and

e. The parties may by stipulation filed with the Court change any other deadline in the pretrial order that falls before January 17, 2017.

It is also ORDERED that respondent's November 4, 2016 motion to depose John G. Branca pursuant to Rule 74(c)(3) is granted.

It is also ORDERED that respondent's November 4, 2016 motion to depose John McClain pursuant to Rule 74(c)(3) is denied.

It is also ORDERED that respondent's November 18, 2016 motion to compel the deposition of nonparty witness Karen Langford is granted.

It is also ORDERED that respondent's November 22, 2016 motion to compel the deposition of nonparty witness Michael Kane is granted.

It is also ORDERED that respondent shall file another motion to compel depositions on or before December 9, 2016, suggesting specific dates, times, and places for depositions, ifbefore then he is unable to reach agreement on these details with the witnesses or their counsel.

It is also ORDERED that petitioner's November 30, 2016 motion to compel answers to interrogatories and requests for production of documents and compliance with

the Court's order ofAugust 31, 2016 is granted only as to: (a) interrogatories 2, 5, 8, 11, 12, and 13(c); (b) document requests 7 and 8, but only to the extent any such statements or documents relate to the issues remaining in the case and are not respondent's own statements or documents; and (c) any documents received in response to respondent's subpoena duces tecum served on Joseph Zimring.

Respondent shall, on or before December 19, 2016, serve on counsel for petitioner complete responses to these interrogatories and complete production ofthese documents.

It is also ORDERED that respondent's November 30, 2016 motion to compel the production of documents is granted and petitioner shall produce to counsel for respondent those documents requested in respondent's requests 13, 19, and 20 of respondent's first request for the production of documents; and requests 1-6, 9, 11,and 12 of his second set. In producing documents described in requests 13 and 19, petitioner shall produce the word-tally list and other information pertaining to technology-assisted searches for documents potentially responsive to theserequests as described in respondent's October 12, 2016 letter to petitioner and attached as Exhibit W to his motion. Petitioner shall, on or before December 19,2016, serve on counsel for respondent complete production ofthese documents.

It is also ORDERED that respondent's November 7, 2016 motion in limine to exclude the expert-witness report of Eugene Volokh is granted.

A lot of new information at the latest court ruling about discovery

The parties have filed several motions that the Court needs to decide. Two -- a motion for extension of time for petitioner to respond to requests for admissions, and a motion to seal two documents that are exhibits to petitioner's answer to yet another motion -- are unopposed. The parties also filed a stipulationto slightly change some pretrial deadlines. The Court will grant all of these.

The contested motions are:

Deposition of John Branca

Branca is one ofthe two co-executors of Jackson's will and is actively involved in the estate's businesses and financial planning. Our Court allows depositions of parties, but still treats them as "an extraordinary method of discovery." Rule 74(c)(1)(B). What this division ofthe Court looks for is the general state of discovery, the stakes involved, and whether the depositions would materially aid the trial and possible settlement ofthe cases. The key fact here is that the stakes in this case exceed $1 billion. The Court acknowledges the parties' disagreements about how cooperative each has been in informal discovery, but in a case of this size there is bound to be toing-and-froing between two highly qualified teams of lawyers. It is reasonable to lock down the testimony of a central witness on the key underlying facts, which should shorten the trial and better focus it on what are likely to be quite complicated valuation issues. Respondent's motion is reasonable, and the marginal cost small in relation to the stakes. We will grant respondent's motion.

Deposition of John McClain

McClain is the other co-executor of Jackson's will. His involvement in the day-to-day management ofthe estate's affairs is very unclear from the motion papers. In the motion seeking Branca's deposition, McClain is described as a manager of Triumph Intemational, Inc. which holds and exploits the trademarks related to Jackson on behalf ofthe estate. He is also described as very seriously ill and subject to very poor reactions to stress -- descriptions buttressed by specifics from his doctors that the Court will seal out ofrespect for his privacy -- that would seem inconsistent with the ability to manage a complex enterprise in an industry not widely known for the placidity with which its commercial activity is carried out. Petitioner opposes this motion for essentially the same reasons it does that of Branca, but with the additional and understandable desire to protect McClain's health. McClain's testimony would overlap Branca's in part; but McClain's long friendship with Jackson and his almost equally long involvement in Jackson's music business means that this overlap is not perfect. We will deny this motion. But should respondent issue a trial subpoena for his testimony, and should petitioner or McClain object to it, the Court would expect to hold a brief hearing to determine if McClain's health has interfered with his ability to tend to the estate's day-to-day business.

Deposition of Karen Langford

Langford is an experienced paralegal who participated in the valuation of Jackson's image for the estate's return. She also is knowledgeable about some of the other assets ofthe estate -- for example, unreleased music -- that McClain was also knowledgeable about. His ill health makes her a more important witness. The stakes involved strongly suggest that the costs of formal discovery are reasonable. The Court is also convinced, after reviewing the paperwork, that the deposition of

this witness would materially aid trial of this case. We will grant this motion.

Deposition of Michael Kane

Kane is an accountant and Jackson's former business manager, and has worked on appraisals for the estate and the estate's tax return -- and has even been consulted by petitioners' experts for their work. Respondent also identifies him as a key witness on the penalty issues in the case. Petitioner objects on the grounds that other forms of discovery could be used. Much as with Langford, however, the stakes involved strongly suggest that the costs of formal discovery through themore flexible mechanism of depositions are reasonable. The Court is also convinced, after reviewing the paperwork, that the deposition ofthis witness would

also materially aid trial ofthis case.

Petitioner's Motion to Compel

The estate moved to compel answers to interrogatories, requests for document production, and compliance with a previous discovery order. 1. Interrogatories. Interrogatory 1 is a contention interrogatory aimed at finding out respondent's reason for determining a much higher value for Jackson's likeness. Respondent's answer -- relying on his expert -- is adequate.

Interrogatory 2 seeks the identification of witnesses with knowledge ofthat issue to which respondent replied that he had either named any such witnesses in theexpert report or would include them on his witness list. This is not adequate -- the identification of witnesses is a core object of discovery.

Interrogatories 4 and 5 (about the value ofthe estate's interest in Sony/ATV) and 7 and 8 (about the value ofthe estate's interest in Mijac) follow the same pattern: Look to my experts' reports, says respondent; but ifthe names you seek aren't there, wait for the witness list. Our ruling will likewise be the same.

Interrogatories 11 and 12 ask respondent to identify any people he has interviewed about any of the remaining issues in the case and any who submitted written statements to him. Respondent objects on work-product grounds but, as petitioner correctly notes, petitioner isn't seeking any information about respondent or his representatives but only third parties. With this minor clarification, we agree with petitioner that the information these interrogatories seek is discoverable.

Interrogatory 13 asks for information about the penalties that respondent determined apply to the valuation issues in the case that are still in dispute. On this one, respondent incorporated his answers to previous interrogatories. Our ruling here is consistent with those -- that respondent's answers to 13(a) and (b) are adequate, but he must answer 13(c).

2. Document Production. Petitioner asks us to compel production of two of its requests, numbers 7 and 8. These resemble some of the contested interrogatories in that they seek production of written statements and documents "provided to respondent by any person concerning any issue in this case." Respondent objects on the ground that they are vague, burdensome, and ambiguous. Maybe, if one squinted hard enough. But in context, petitioner is not seeking anything about issues that have already settled -- it's concerned with the three remaining valuation issues and associated penalties. We also don't construe this request to seek work product but only statements and documents from nonparties. With that possibly unnecessary qualification, we will grant this part of petitioner's motion.

3. Compliance with previous order. Petitioner also seeks any documents produced in response to the subpoena duces tecum served on Joseph Zimring. It is possible that respondent's answer to one ofthe interrogatories says there were such documents. If so, respondent must comply with our earlier order.

Respondent's motion to compel production of documents

Respondent seeks, in his own motion to compel, document production that he thinks was inadequate. All his requests seek discoverable information, but petitioner had other objections.

Request number 9 of respondent's second set of document requests seeks any cease-and-desist letters the estate sent to those it thought might be exploiting Jackson's likeness without authorization.

Request number 11 of this set seeks the minutes of Sony/ATV in connection with the estate's sale of its interest in this entity to Sony.

Request number 12 ofthis set asks for appraisals ofthat interest in connection with this sale. These requests are limited and seek discoverable information.

We will grant this part of the motion without further elaboration.

There is another whole category of requests at issue (numbers 13, 19, and 20 in respondent's first set of document requests; and 1-6 of his second set). These are potentially quite burdensome requests for correspondence or agreements between the estate and various businesses interested in using the estate's property,mostly Jackson's image or music. Petitioner did produce some documents in this category ofrequests but also made numerous objections, none ofwhich justify holding back any documents. Where it made a claim of privilege, the estate needed to produce a privilege log so as to enable in camera review or a "quick peek" order under FRE 502; where it took upon itself the burden ofredaction of information it thought "nonresponsive", it violated our Rule 72 because that is not producing them as they are kept in the ordinary course of business; and where it didn't produce them because they contained confidential business information, because they should be produced under seal.

Respondent makes an interesting argument about petitioner's responses to requests number 13 and 19: petitioner's failure to provide a word-tally list or search-term hit frequency. Using such tools can reduce what might otherwise be quite a burdensome exercise; moreover, such terms are themselves a way to cabin discovery. We do not think their use in this large a case would be overly burdensome and will order its use in compliance with this order.

Respondent's motion in limine to exclude the Volokh report

Professor Eugene Volokh of UCLA Law School is widely acknowledged as one ofthe country's leading scholars of First Amendment law, Second Amendment law, and torts. He is even a member ofthe American Heritage Dictionary's Usage Panel. For this case he has prepared an expert-witness report in which he offers his opinion ofthe scope of"legal rights that a prospective buyer would consider when deciding the value of Michael Jackson's name, voice, and likeness (as defined in Cal. Civ. Code § 3344.1)." He's been retained because any deals in this area "will be made in the shadow ofthe law, by parties who are legally sophisticated and well-

counseled." This must be true: A hypothetical rational buyer would not pay the same for narrower rights than he would for broader ones, or the same for uncertain rights than he would for established ones. So it also has to be true that the value of this most contested asset of the estate -- Jackson's posthumous right ofpublicity depends on its legal limits. Professor Volokh opines not on the value of this asset, but on those limits. This means that his report falls within a fairly well-hardened rule that expert testimony about domestic law is generally not admissible. Estate ofCarpenter v. Commissioner, 65 T.C.M. (CCH) 2119, 2120 (1993). This rule is usually accompanied by the line that "testimony about the law does not assist the court." Judges may pretend this is so, but in their hearts they know that many of the lawyers who appear before them know much more about the law than they do. So the rule would be a weak one ifit was helpfulness in reaching the correct result that we focused on. But the rule would be a strong one ifwe focused on the difference between findings of fact and conclusions of law. Courts mostly serve as human lie detectors in evaluating testimony -- they ask ifthe witness broke down on cross, engaged in self-contradiction, or told an incoherent story. Judges are not supposed to conduct private investigations outside the record into the facts of a case. But in reaching a legal conclusion, a judge is less constrained. He is able to consult his own resources and expertise, and looks to the advocates who appear before him for help in where to look. We expect lawyers to zealously advocate for their clients; we're suspicious of witnesses who do so. This is true even when issue before the Court is a mix of law and fact, as it is in the valuation questions in this case. Professor Volokh's proffered testimony would be helpful in drawing the bounds ofthe estate's rights in Jackson's image. But the rule excluding testimony about the content of domestic law is a strong one in this Court. His legal expertise can help the estate to prepare for examination before trial and in argument after the trial, but we find it inadmissible as testimony during the trial. We will grant respondent's motion.

To sum up, it is

ORDERED that petitioner's November 21, 2016 motion to extend the time it has to answer respondent's request for admissions is granted, and petitioner shall serve its answer as supplemented on or before December 5, 2016.

It is also ORDERED that petitioner's December 2, 2016 motion to seal documents is granted, and exhibits A and B to petitioner's opposition to motion to take deposition of John McClain shall be sealed.

It is also ORDERED that the Court will adopt the parties' November 21, 2016 stipulation of pretrial deadlines, and amends the pretrial order in this case asfollows:

a. The last day for filing discovery motions other than to depose expert witnesses shall be extended to November 30, 2016 nunc pro tunc;

b. The last day for filing motions under Rule 90 to contest the sufficiency of answers to requests for admission shall be extended to December 23, 2016;

c. The last day for filing any motions to depose expert witnesses shall be December 23, 2016;

d. Ifthe parties stipulate to taking expert-witness depositions, any notices of those depositions shall be served at least 15 days prior to the scheduled date of thedeposition; and

e. The parties may by stipulation filed with the Court change any other deadline in the pretrial order that falls before January 17, 2017.

It is also ORDERED that respondent's November 4, 2016 motion to depose John G. Branca pursuant to Rule 74(c)(3) is granted.

It is also ORDERED that respondent's November 4, 2016 motion to depose John McClain pursuant to Rule 74(c)(3) is denied.

It is also ORDERED that respondent's November 18, 2016 motion to compel the deposition of nonparty witness Karen Langford is granted.

It is also ORDERED that respondent's November 22, 2016 motion to compel the deposition of nonparty witness Michael Kane is granted.

It is also ORDERED that respondent shall file another motion to compel depositions on or before December 9, 2016, suggesting specific dates, times, and places for depositions, ifbefore then he is unable to reach agreement on these details with the witnesses or their counsel.

It is also ORDERED that petitioner's November 30, 2016 motion to compel answers to interrogatories and requests for production of documents and compliance with

the Court's order ofAugust 31, 2016 is granted only as to: (a) interrogatories 2, 5, 8, 11, 12, and 13(c); (b) document requests 7 and 8, but only to the extent any such statements or documents relate to the issues remaining in the case and are not respondent's own statements or documents; and (c) any documents received in response to respondent's subpoena duces tecum served on Joseph Zimring.

Respondent shall, on or before December 19, 2016, serve on counsel for petitioner complete responses to these interrogatories and complete production ofthese documents.

It is also ORDERED that respondent's November 30, 2016 motion to compel the production of documents is granted and petitioner shall produce to counsel for respondent those documents requested in respondent's requests 13, 19, and 20 of respondent's first request for the production of documents; and requests 1-6, 9, 11,and 12 of his second set. In producing documents described in requests 13 and 19, petitioner shall produce the word-tally list and other information pertaining to technology-assisted searches for documents potentially responsive to theserequests as described in respondent's October 12, 2016 letter to petitioner and attached as Exhibit W to his motion. Petitioner shall, on or before December 19,2016, serve on counsel for respondent complete production ofthese documents.

It is also ORDERED that respondent's November 7, 2016 motion in limine to exclude the expert-witness report of Eugene Volokh is granted.

- soulmum

- Utente certificato

- Messaggi: 9304

- Iscritto il: 31 maggio 2016, 12:43

Re: Michael Jackson’s Estate Challenges IRS in Tax Dispute

Michael Jackson's Executor, Manager Ordered to Testify in Billion-Dollar Tax Battle

The tax trial of the century -- one focused on the worth of late pop singer Michael Jackson when he died in 2009 -- is set to begin this February. With more than $1 billion at stake, the Internal Revenue Service and Michael Jackson's estate are scrambling in these final pre-trial days to discover everything they need to know before heading into battle.

This week, U.S. Tax Court Judge Mark Holmes granted a heavily contested motion by the IRS to depose John Branca, one of the two co-executors of Jackson's will; Michael Kane, the singer's former business manager; and Karen Langford, a paralegal said to have participated in the valuation of Jackson's image and knowledgeable about unreleased music.

But John McClain, the other co-executor of Jackson's will, won't be giving a deposition.

Although McClain currently manages an outfit that exploits Jackson trademarks, Holmes writes in his order that McClain is described in court papers as "very seriously ill and subject to very poor reactions to stress," commenting that this "would seem inconsistent with the ability to manage a complex enterprise in an industry not widely known for the placidity with with its commercial activity is carried out."

To protect his health, McClain won't have to testify just yet, but the judge isn't ruling out that he may have to do so at trial if the IRS insists and after potential briefing by the parties.

Judge Holmes has also ordered a variety of documents to be shared with the IRS including cease-and-desist letters the estate has sent to those it thought might be exploiting Jackson's likeness without authorization, the minutes of the estate's sale of its interest in Sony/ATV to Sony, and appraisals of that sale reported to be worth about $750 million.

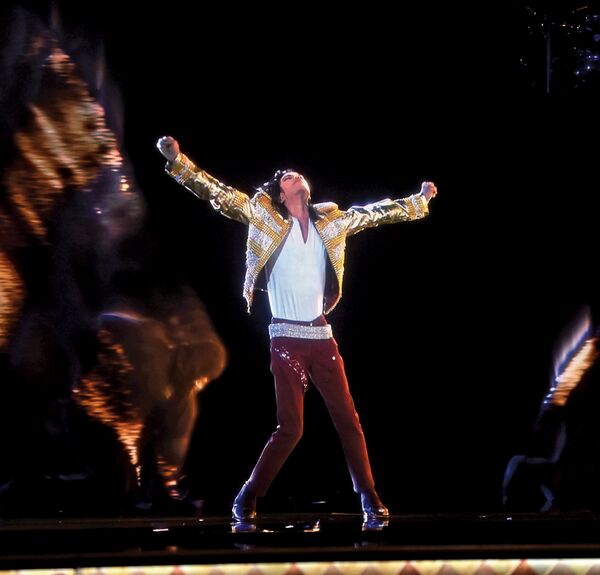

The big ticket item at the current trial -- and the reason why the case is of special interest throughout the entertainment industry -- will be valuating Jackson's posthumous right to his likeness. The IRS has insisted it's worth more than $434 million and may point as evidence to the 2009 documentary This Is It, a Cirque du Soleil tribute show, and post-death albums, video games and other lucrative memorials. The estate's own valuation is just $2,105, arguing that what's important is the value when he died, when Jackson's commercial prospects were suffering from charges of child molestation and drug abuse, before executors worked their magic, and the King of Pop experienced a resurgence in popularity.

The coming valuation analysis and conclusions will be informed by what licensors theoretically would be willing to pay for rights. To this end, Jackson's estate commissioned UCLA Law School professor Eugene Volokh, one of the leading scholars of First Amendment law and torts, to prepare a report on the subject of how the value of a celebrity like Jackson depends on the legal limits of the posthumous right of publicity.

The IRS brought a motion to exclude Volokh's report as inadmissible since it's the judge deciding conclusions about the law. Experts only render opinions informed by facts.

"This is true even when issue before the Court is a mix of law and fact, as it is in the valuation questions in this case," writes Holmes in response to the IRS' motion. "Professor Volokh's proffered testimony would be helpful in drawing the bounds of the estate's rights in Jackson's image. But the rule excluding testimony about the content of domestic law is a strong one in this Court. His legal expertise can help the estate to prepare for examination before trial and in argument after the trial, but we find it inadmissible as testimony during the trial."

http://www.billboard.com/articles/ne...ion-dollar-tax

The tax trial of the century -- one focused on the worth of late pop singer Michael Jackson when he died in 2009 -- is set to begin this February. With more than $1 billion at stake, the Internal Revenue Service and Michael Jackson's estate are scrambling in these final pre-trial days to discover everything they need to know before heading into battle.

This week, U.S. Tax Court Judge Mark Holmes granted a heavily contested motion by the IRS to depose John Branca, one of the two co-executors of Jackson's will; Michael Kane, the singer's former business manager; and Karen Langford, a paralegal said to have participated in the valuation of Jackson's image and knowledgeable about unreleased music.

But John McClain, the other co-executor of Jackson's will, won't be giving a deposition.

Although McClain currently manages an outfit that exploits Jackson trademarks, Holmes writes in his order that McClain is described in court papers as "very seriously ill and subject to very poor reactions to stress," commenting that this "would seem inconsistent with the ability to manage a complex enterprise in an industry not widely known for the placidity with with its commercial activity is carried out."

To protect his health, McClain won't have to testify just yet, but the judge isn't ruling out that he may have to do so at trial if the IRS insists and after potential briefing by the parties.

Judge Holmes has also ordered a variety of documents to be shared with the IRS including cease-and-desist letters the estate has sent to those it thought might be exploiting Jackson's likeness without authorization, the minutes of the estate's sale of its interest in Sony/ATV to Sony, and appraisals of that sale reported to be worth about $750 million.

The big ticket item at the current trial -- and the reason why the case is of special interest throughout the entertainment industry -- will be valuating Jackson's posthumous right to his likeness. The IRS has insisted it's worth more than $434 million and may point as evidence to the 2009 documentary This Is It, a Cirque du Soleil tribute show, and post-death albums, video games and other lucrative memorials. The estate's own valuation is just $2,105, arguing that what's important is the value when he died, when Jackson's commercial prospects were suffering from charges of child molestation and drug abuse, before executors worked their magic, and the King of Pop experienced a resurgence in popularity.

The coming valuation analysis and conclusions will be informed by what licensors theoretically would be willing to pay for rights. To this end, Jackson's estate commissioned UCLA Law School professor Eugene Volokh, one of the leading scholars of First Amendment law and torts, to prepare a report on the subject of how the value of a celebrity like Jackson depends on the legal limits of the posthumous right of publicity.

The IRS brought a motion to exclude Volokh's report as inadmissible since it's the judge deciding conclusions about the law. Experts only render opinions informed by facts.

"This is true even when issue before the Court is a mix of law and fact, as it is in the valuation questions in this case," writes Holmes in response to the IRS' motion. "Professor Volokh's proffered testimony would be helpful in drawing the bounds of the estate's rights in Jackson's image. But the rule excluding testimony about the content of domestic law is a strong one in this Court. His legal expertise can help the estate to prepare for examination before trial and in argument after the trial, but we find it inadmissible as testimony during the trial."

http://www.billboard.com/articles/ne...ion-dollar-tax

- soulmum

- Utente certificato

- Messaggi: 9304

- Iscritto il: 31 maggio 2016, 12:43

Re: Michael Jackson’s Estate Challenges IRS in Tax Dispute

https://www.bloomberg.com/news/featu...-a-piece-of-it

Michael Jackson Is Worth More Than Ever, and the IRS Wants a Piece of It

Jackson’s star lawyer made a mint for his heirs, so now the government has to be startin’ somethin’.

Seven years after Michael Jackson’s fatal overdose of propofol and lorazepam in 2009, the statute of limitations on gossiping about the deceased is, apparently, over. In one of her rare interviews in the midst of the presidential campaign, future First Lady Melania Trump told the luxury magazine DuJour how Jackson, a friend of Donald’s and onetime Trump Tower resident, mischievously suggested they kiss to make her husband jealous. Then Madonna, on CBS’s Late Late Show, revealed that she’d smooched amorously with him long ago. And the New York Post’s Page Six dropped a chunk from Tommy Hilfiger’s memoir, American Dreamer: My Life in Fashion and Business, about the designer’s visit in the 1990s at Neverland Ranch, the singer’s compound in Santa Barbara County, Calif. After encountering a giraffe and a string of baby elephants outside, Hilfiger found Jackson in his office, with a bandage on his nose, wearing sunglasses and sitting on “an enormous gold-and-burgundy throne.” His two oldest children, Prince and Paris, were there, dressed “like characters from a Broadway show or The Sound of Music—velveteen knickers, dirndl jumper, ruffled blouses, patent leather shoes, each in full makeup.”

Paris, in response to such banter and because she’s now 18, just gave her first full-length interview in a Rolling Stone cover story, setting the record straight: She’d had a wonderful childhood until her father’s death at age 50. After, she struggled with drugs and attempted suicide several times, but she’s now happy, clean, and, the magazine reports, “heir to a mammoth fortune—the Michael Jackson Trust is likely worth more than $1 billion, with disbursements to the kids in stages.”

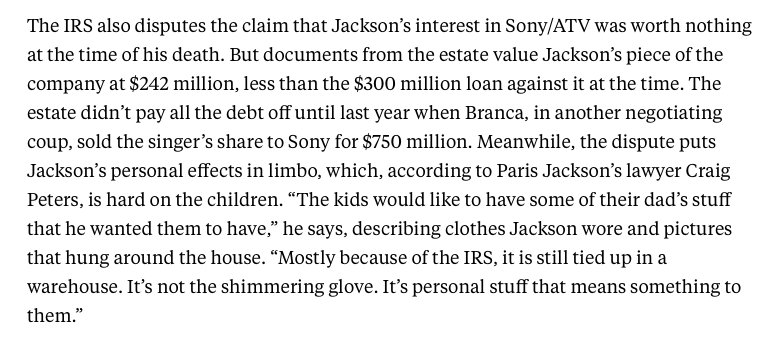

That number could change if the IRS has anything to do with it. The agency’s lawyers are taking the executors to trial, set to begin sometime this month in U.S. Tax Court in Los Angeles. The IRS intends to prove that $702 million of that inheritance is owed in penalties and back taxes. The crux of the case is the disputed value of Jackson’s name and likeness, which is to say the right to use his visage on everything from coffee cups to baseball caps. An estate tax filing is supposed to be a snapshot of the person’s assets on the day of his expiration, and under California law that includes the value of a star’s name and likeness. The IRS claims Jackson’s should have been valued at $434 million. The estate claims that it was worth a mere $2,105, implying that his image had been rendered all but worthless by stories about skin bleaching, his obsession with plastic surgery, prescription drug abuse, odd parenting choices—such as covering his children’s faces in black veils or Spider-Man masks in public—and allegations that he molested young boys who visited Neverland.

Celebrity estate lawyers are watching closely. It felt like a record year for the deaths of icons in 2016, with the passing of Prince, David Bowie, Leonard Cohen, Merle Haggard, Muhammad Ali, and Debbie Reynolds and her daughter Carrie Fisher. Fisher’s December departure prompted reports that Walt Disney was rushing to make a deal to use her digital likeness in future Star Wars movies. (Disney denied this.) The Jackson case signals that tax examiners see enhanced value in a deceased star’s face and name as technology and social media open up novel paths to profit, such as the ability to conjure up appearances using computer-generated imagery and voice software.

The man largely responsible for the estate’s current fiscal health is not Michael Jackson, or not exactly. For the balance of the past 37 years, a 66-year-old Los Angeles entertainment attorney named John Branca, a partner at the firm Ziffren Brittenham, has handled the singer’s record deals and tried to shield him from his own worst impulses. After Jackson’s death, Branca and John McClain, a veteran music industry executive and former Jackson confidant who keeps a lower profile (and declined to be interviewed for this story), were appointed executors of the singer’s estate, which gave them responsibility for generating income for the beneficiaries named in his will—his children Prince, Paris, and Blanket, and his mother, Katherine Jackson, whom he designated as their guardian.

“Michael used to say to me, ‘You and I, Branca, we’re going to be examples for the business, we’re going to be the kings,’ ” Branca says. It’s early July, and he’s reclining in the opulently furnished living room of his home in a gated community high in Beverly Hills. He looks like an aging rock star himself, intent on defying the calendar. He’s slim, brown-haired, and dressed fashionably in a black polo shirt, black pants, and expensive-looking black leather sneakers. The twice-divorced Branca is engaged to Jenna Hurt, a 32-year-old model who makes a brief appearance and then withdraws to let her fiancé hold court. The walls are covered with signed portraits of clients extolling his expertise, including Berry Gordy, the former head of Motown Records, the Eagles’ Don Henley, Brian Wilson of the Beach Boys, and, of course, Jackson, who can be seen posing happily with Lisa Marie Presley, his first wife. Branca casually notes that he introduced them.

It all might be too self-congratulatory if Branca himself weren’t so convivial. He grew up in Mount Vernon, N.Y., the nephew of the late Ralph Branca, a three-time All-Star pitcher for the Brooklyn Dodgers. Branca liked sports—he became an avid baseball card collector—but he was more interested in music. His parents divorced, and he eventually moved to Los Angeles to live with his mother, a dancer. As a teenager, Branca was kicked out of the Chadwick School in Palos Verdes Peninsula, Calif., and played keyboards in a band that opened for the Doors on the Sunset Strip in the ’60s.

Branca enrolled in Los Angeles City College to study music, where he got A’s on his harmony papers but felt out of his league when it came to playing with some of his fellow students, among them pianist Les McCann, a future soul-jazz great. “I just looked around and said, ‘This is ridiculous. I don’t belong here,’ ” Branca recalls. So he got a law degree at UCLA in 1975 and found a job working for the late entertainment lawyer David Braun. Braun, whose clients included Bob Dylan, Neil Diamond, and former Beatle George Harrison, was established enough not to bother keeping up. One day the Beach Boys came into the office. “David didn’t even know who they were and didn’t care,” Branca says. “So he sent me to the meeting. I was 27 years old at the time, and all of a sudden, I became the Beach Boys’ lawyer.”

“I’ve got fun pictures of Bubbles with my ex-wife and people at the wedding”

Fortuitously, the Beach Boys’ accountant also did Jackson’s taxes. In 1980 he introduced Braun and Branca to the ascendant pop star, who’d recently turned 21 and was in the process of distancing himself from his domineering father and primary manager, Joseph Jackson. Branca found Jackson pleasantly eccentric. “He had sunglasses on, and he pulled them down and he goes, ‘Do I know you?’ ” Branca recalls. “I go, ‘I don’t think we’ve met, but I look forward to getting to know you.’ And he goes, ‘Are you sure we don’t know each other?’ I said, ‘Michael, I would remember if we had met.’ ” The next day, Branca got a call from the accountant. Jackson was hiring him to be his attorney.

One of the first things Branca did was renegotiate what he describes as Jackson’s “absurd” contract with his label, Epic Records, winning him a royalty rate that only a few artists such as Dylan enjoyed at the time. When Jackson was ready to unveil Thriller, he wanted to spend $1.2 million on the video for the title track. Branca protested—this was a time when music videos typically cost $50,000—but Jackson curtly told him, “I don’t care. Just figure it out.” Branca persuaded Showtime and MTV to pay a total of $600,000 for a movie about the making of the Thriller video and got another company to spend $400,000 on the home video rights. The finished 13-minute film featured a troupe of corpses rising from a conveniently located graveyard to dance with a zombielike Jackson, their knees high and claws up. Jackson, then a Jehovah’s Witness, decided it was blasphemous and should be destroyed. Branca came up with another crafty fix. He told his client that Bela Lugosi, the star of the classic 1931 Dracula, was also religious and had had the movie’s producers include a disclaimer to the theatrical release saying it didn’t represent his personal views. “It was a complete fabrication,” Branca says, laughing. Jackson added the disclaimer, and the hugely popular video helped propel the album’s sales to 100 million copies worldwide. It’s still the best-selling record ever.

In 1984, Branca learned that the Australian corporate raider Robert Holmes à Court was shopping a company called ATV Music, which held the rights to more than 200 Beatles songs, including Yesterday, Revolution, The Long and Winding Road, and Hey Jude. An excited Jackson told Branca to spend whatever it took to acquire ATV. “It’s my catalogue!” he wrote in a note. But Jackson and Branca’s $47.5 million offer was beaten by Marty Bandier and Charles Koppelman, two New Yorkers who promised $50 million.

Bandier remembers flying to London on the Concorde with Koppelman to meet with Holmes à Court. “We thought it was a closing,” he says. He noticed Branca on the same plane but didn’t think anything of it. When they arrived, Holmes à Court said he’d accepted Jackson’s lower bid. Branca had offered to let the seller’s daughter, named Penny, keep the rights to the Beatles classic Penny Lane. He’d also agreed to have Jackson appear for an hour at an event in Perth put on by Holmes à Court’s favorite charity. “It was depressing,” Bandier recalls. Branca sold off the rights to the catalog’s cinematic background music for $6 million, which brought the effective price down to $41.5 million. In the end, Jackson, who borrowed $30 million to cover his costs, put only $11.5 million in cash on what would become his life raft when he was drowning. Jackson gave Branca a Rolls-Royce for his efforts.

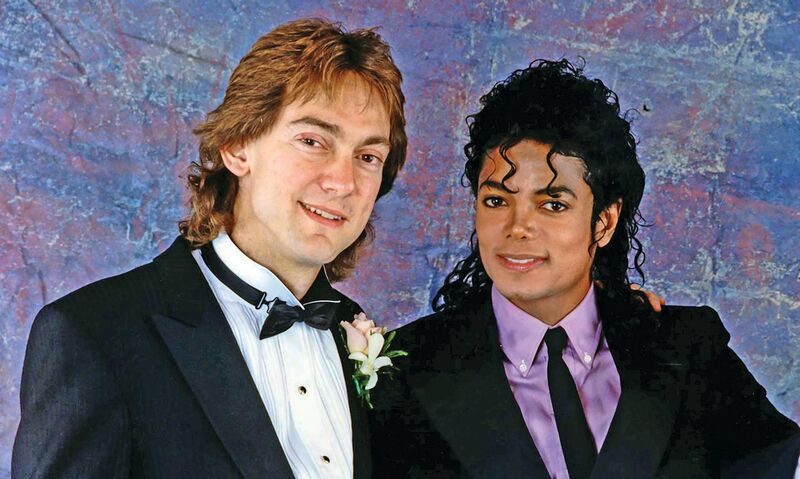

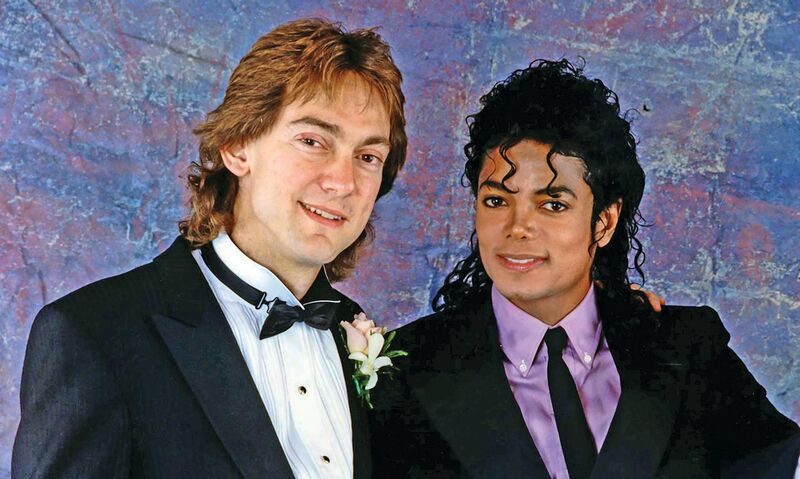

Three years later, Branca helped Jackson buy Neverland, listed at $60 million, for $17.5 million. Jackson was so pleased that he rewarded his attorney with another Rolls-Royce. Around the same time, Jackson was best man at Branca’s wedding to his first wife. He brought along his beloved chimp, Bubbles, in a matching tuxedo. “I’ve got fun pictures of Bubbles with my ex-wife and people at the wedding,” Branca says nostalgically. Little Richard, it should be noted, performed the service.

Jackson was best man at Branca’s first wedding.

Source: John Branca

As things got rocky for Jackson, so did his relationship with Branca. Various people competed for the performer’s ear, and Branca was fired, then rehired in 1993 when the star was in the throes of the first molestation accusations, which were settled in a civil suit for what was widely reported to have been $20 million. Branca, now back in charge, thwarted other advisers who were pushing for Jackson to sell half of ATV to Sony for $75 million to cover his costs. By 1995 he’d negotiated a deal for Jackson to merge ATV with Sony’s music publishing company in exchange for $115 million and a yearly stipend that started at $10 million.

That year, Jackson prepared the first of his wills, naming Branca and McClain as his executors. It was updated twice, as he had children, but the document essentially stayed the same.

It was getting harder for Branca to protect Jackson, though. He was abusing prescription drugs and acting strangely. He spent $30 million, a record sum, to record Invincible, his splendid final studio album, released in 2001. Jackson blamed Sony when it sold a mere 8 million copies, a hit for any other artist. In July 2002, Jackson, looking pale and Kabuki-like, held a series of press conferences in New York in which he described himself as a victim of a racist music industry with a history of ripping off black artists like himself. He made headlines that year when he dangled infant Blanket over the railing of a hotel room in Germany so his fans could get a look.

Jackson overrode Branca’s attempts to control how British television producer Martin Bashir used interviews in the show Living With Michael Jackson, which aired in 2003. In it, Jackson admitted he sometimes shared his bedroom with the youngsters who visited Neverland, including a young cancer survivor who sat beside him on camera, and blithely insisted that it was nothing unusual. Soon after, the boy’s family accused Jackson of molesting him, which led to a criminal trial. In 2005 he was acquitted by a jury in Santa Maria, Calif. By then, Branca had been fired again, though he continued to get calls for help from Jackson’s advisers. Finally, the Jackson maelstrom became too much, and Branca walked away from his former best man.

Without Branca, Jackson floundered. He was no longer releasing records or touring, so the only way he could afford his lifestyle was by basically borrowing against his half of Sony/ATV. By 2008 his debt secured by the publishing company had swelled to $300 million. Fortress Investment, a New York hedge fund, purchased his mortgage on Neverland and threatened to foreclose if Jackson didn’t pay up.